This is Article #2 in the Customer Retention series.

This 9 part series teaches you how to build a predictable customer retention strategy. By the end of this series, you’ll be on your way to confidently increasing your customer retention.

Article 1 Why Customer Retention Is So Hard to Improve

In the last article we covered why it’s so challenging to improve customer retention. (It has to do with uncovering and changing the emotional points in the post-sale customer journey that tie to the 25 Customer Churn Factors, including avoiding the dreaded Buyer’s Remorse.) Many of the Customer Churn Factors don’t have an obvious or straightforward solution, which can be overwhelming. To make it easier, we looked at onboarding as the best starting point and how to prioritize which changes to make first.

Knowing where to start is . . . a good start.

However, you’ll need tools to help you make the bigger changes that will have a measurable impact on retention. Two of these tools, you’re likely already employing or know about them. The 3rd tool may not be something you’re familiar with, but I think is the most powerful of the 3 tools in terms of increasing customer retention.

Customer retention tool #1

Bits & Pieces

Nearly every company has some customer retention activities. These activities may include sending and acting on low Net Promoter Score (NPS), Customer Satisfaction (CSAT) and Customer Effort (CES) survey responses, using Customer Health Scores to identify at-risk accounts, and undertaking churn interviews, to name a few.

If your company is using all or just a few of these activities . . . Congratulations!

These and other retention activities are a big step toward improving customer retention.

The biggest issue with these activities is – they’re just activities. Rarely are they a part of a cohesive customer retention strategy. They are simply bits & pieces of retention activities that are sprinkled throughout the customer journey.

Early growth companies often have higher churn rates than more mature companies. They are also more likely to have a ‘bits & pieces’ approach to customer retention activities. I’ve heard many potential clients say to me that ‘some is better than none’, meaning that some retention activities are better than no activities at all. While this may be a desirable approach for a very short time, over the long-term early growth companies are unnecessarily losing customers because of this ‘bits & pieces’ approach.

Bits & pieces retention activities are stand alone; they are not tied with other retention activities. This means there’s a lack of leverage and momentum. This lack of leverage and lost momentum translates into more time, higher costs, and more energy trying to budge your retention metrics.

Here’s an example:

Companies that are running NPS, CSAT or CES surveys often have playbooks that are triggered when customers give a low rating on these surveys. The playbook includes reaching out to the customer to find out why they gave such a low rating.

These types of single question surveys have very low response rates, averaging less than 10% — which means 90% of customers never fill them out. If you’re already doing the work of sending the surveys out and responding to those customers with low scores, leverage that effort by also reaching out to non-responders to find out what’s happening with them.

The assumption is that unhappy customers give low scores on surveys. The retention playbook is triggered. A call is made. And hopefully, the sentiment of the customer can be changed.

But this assumption is inaccurate!

In fact, most customers don’t fill out surveys because most companies never respond. The customer may be happy, unhappy or have a neutral sentiment. But you have no idea which sentiment they are because they never submitted a response to your survey. You’ve done the work of putting the survey out there but due to the low response rate, the survey brought you no closer to finding those at-risk or unhappy customers.

Keep reading! The 3rd tool I’ll discuss will show you a system to leverage and keep the momentum moving forward so that your retention activities have more impact with less effort.

Customer retention tool #2

Software

Everyone loves software that makes our lives easier and helps us achieve our goals faster. Software is amazing! Every day there are new tools being created that create solutions for both niche and broad business problems. Artificial Intelligence and Machine Learning are opening up new possibilities and opportunities to serve customers and companies better. It’s an exciting time!

The right software, bought at the right time, can transform a company and have a positive impact on the customers’ experience. It can help increase customer retention while also improving efficiencies and lowering costs.

The challenge with software is ensuring that the right software is bought at the right time to solve the right problems. We’ve all had negative experiences with purchasing software where we weren’t the right fit customer, the timing was wrong, or the solution didn’t solve the problem we needed it to solve. When any of these negatives enter the picture, a software product can cause more issues than it solves.

One of the top reasons for these negative experiences with software is that companies expect the software to fix their problematic processes and procedures. Once implemented, the software tends to amplify existing operational issues rather than solve them.

It’s critical before purchasing software to help you increase your customer retention, that your processes and procedures are optimized. Otherwise, the software will intensify your problems rather than solve them. Not only will you spend more time and resources trying to fix these problems after the fact, but you and your team will also experience needless frustration and upset.

The goal of the software is to help you, not frustrate you! Take the time to fix your processes and procedures before you purchase software. Save yourself, your team, and your customers a world of frustration.

Customer retention tool #3

Customer Insights

We’ve now come to what I think is the most powerful customer retention tool – Customer Insights. The great thing about Customer Insights is that you can use them to supercharge customer retention tool #1 (Bits & Pieces) and customer retention tool #2 (Software).

Customer Insights are any bit of customer information that gives you insights into the behaviors, thoughts, wants, needs, and feelings of your customers. Customer Insights include data from social media comments, employee feedback, call transcripts, online reviews, interviews, surveys, customer advisory board and others.

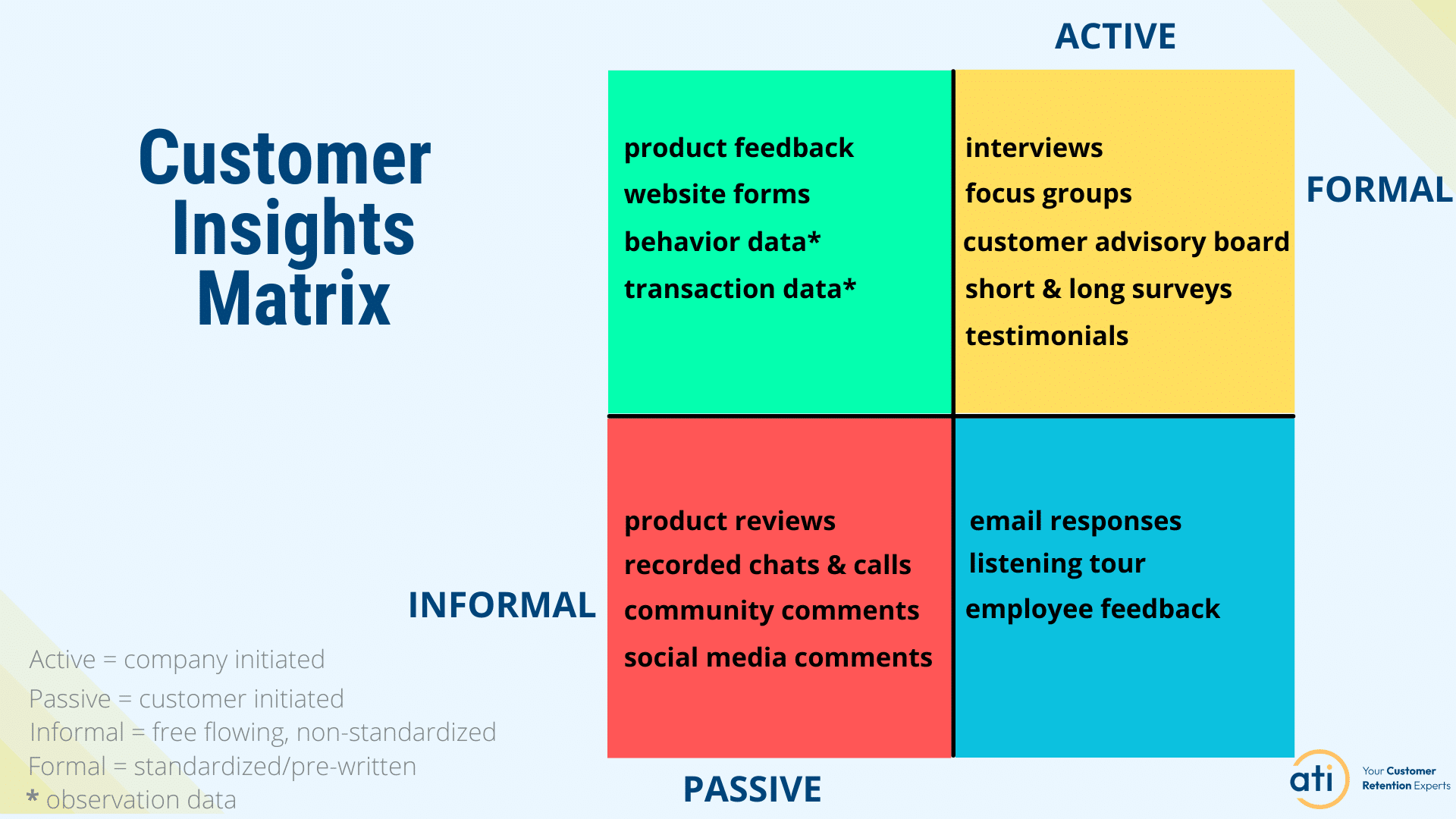

The greatest benefit of Customer Insights is that they give a 360 degree view of what your customers are thinking, feeling, wanting and needing. There are 4 types of insights you can get from your customers: Active, Passive, Informal and Formal.

Active Insights are company initiated. The company is taking an active role in trying to gain these insights. These types of insights include interviews, focus groups, customer advisory board, short & long surveys, testimonials, email responses, listening tours and employee feedback. Companies control when these activities occur.

Passive Insights are customer initiated. The company is taking a passive role. They do not have any control over the type of insights nor when these insights are generated. Passive insights include product feedback, website forms, behavior data, transaction data, customer reviews, chat & call transcripts, community comments, and social media comments.

You may have noticed that there are some activities in the Passive Insights list that the company can control such as website forms and customer reviews. We’re assuming here that website forms sit passively on a website until the customer chooses to engage.

Customer reviews are most often located on review sites that companies have no control over (think Yelp) or the company must create a listing for these sites (think G2 or TrustPilot). In both these cases, the customer initiates when they will want to create a review. In the case where customer reviews sit on the company’s website, those forms sit passively until the customer initiates.

Formal and Informal customer insights are defined by formality. Informal customer insights are free flowing and non-standardized. This means the customer has full autonomy to say or write what is on their mind (think a social media comment). Formal customer insights come from a standard format with pre-written questions or prompts that the company creates (think interviews and surveys). Standardization allows companies to analyze the responses in a methodical way which allows for benchmarking and trend analysis.

The greatest benefit of Customer Insights as a tool for customer retention is that, if properly constructed, it can overcome the shortcomings of Customer Retention tool #1 (Bits & Pieces) and #2 (Software). For software shortcomings, Customer Insights help you understand the bottlenecks and troublesome areas of your processes and procedures. This means you increase your success with your software while giving your customers a better customer experience. It’s a double win!

In the next article, you’re going to learn the best customer retention strategy that uses customer insights to help you increase retention, increase customer satisfaction, and accelerate your revenue growth. This strategy will open a whole new world of retention opportunities for you.

Next article: The Best Customer Retention Strategy for Growing Companies

Churn No More: A Tactical Workshop for Customer Retention

A game-changing workshop designed to help you identify your next high-value retention win and earn a seat at the executive table. Consider it your FastPass to big retention wins.