This is Article #9 in the Customer Retention series.

This 9 part series teaches you how to build a predictable customer retention strategy. By the end of this series, you’ll be on your way to confidently increasing your customer retention.

- Why Customer Retention Is So Hard to Improve

- 3 Tools to Improve Customer Retention (only 1 is software!)

- The Best Customer Retention Strategy for Growing Companies

- How to Build a Predictable Customer Retention Strategy

- How to Use Small Customer Insights to Get Large Customer Retention Wins

- Improve Your Customer Retention: Launching a Customer Retention Strategy

- 5 Proven Steps to Get The Budget for Your Customer Retention Project

- 7 Questions You Need to Ask Before Hiring a Consultant or Services Firm

Congratulations!

You’ve been on quite the journey over the past 8 articles. By now, you’re likely becoming aware that you can start predictably increasing customer retention in your company:

- You have an understanding of why customers choose to stay or leave.

- You have tools and a formula to create your strategy.

- And you know how to create a data story that will help you increase your chances of success when you request money for a bigger customer retention project.

You’ve got a strong foundation to build a predictable strategy that will make things easier for you, better for the company and make more of your customers happy.

I hope you’re starting to feel a little bit of excitement at the possibilities that are waiting for you.

In this last article, we’re taking a high-level view of what you’ve learned so far. Then we’ll cover some of the expert tips you can use to run a customer retention strategy that gets you predictable results.

Let’s dig in!

The Foundation

# 1. Customers make decisions based on feelings first

The foundation of a successful retention strategy is knowing that your customers make the decision to stay or leave based first on their feelings. Then they use reason to justify those feelings.

Customers decide to stay or leave based on their experience with your product and your teams. They will also decide to stay or leave based on whether they see your product as having ‘value’. The perception of value is heavily laden with both rational and emotional factors.

Keep your customer’s emotions in mind.

(Check out article #1 for more information.)

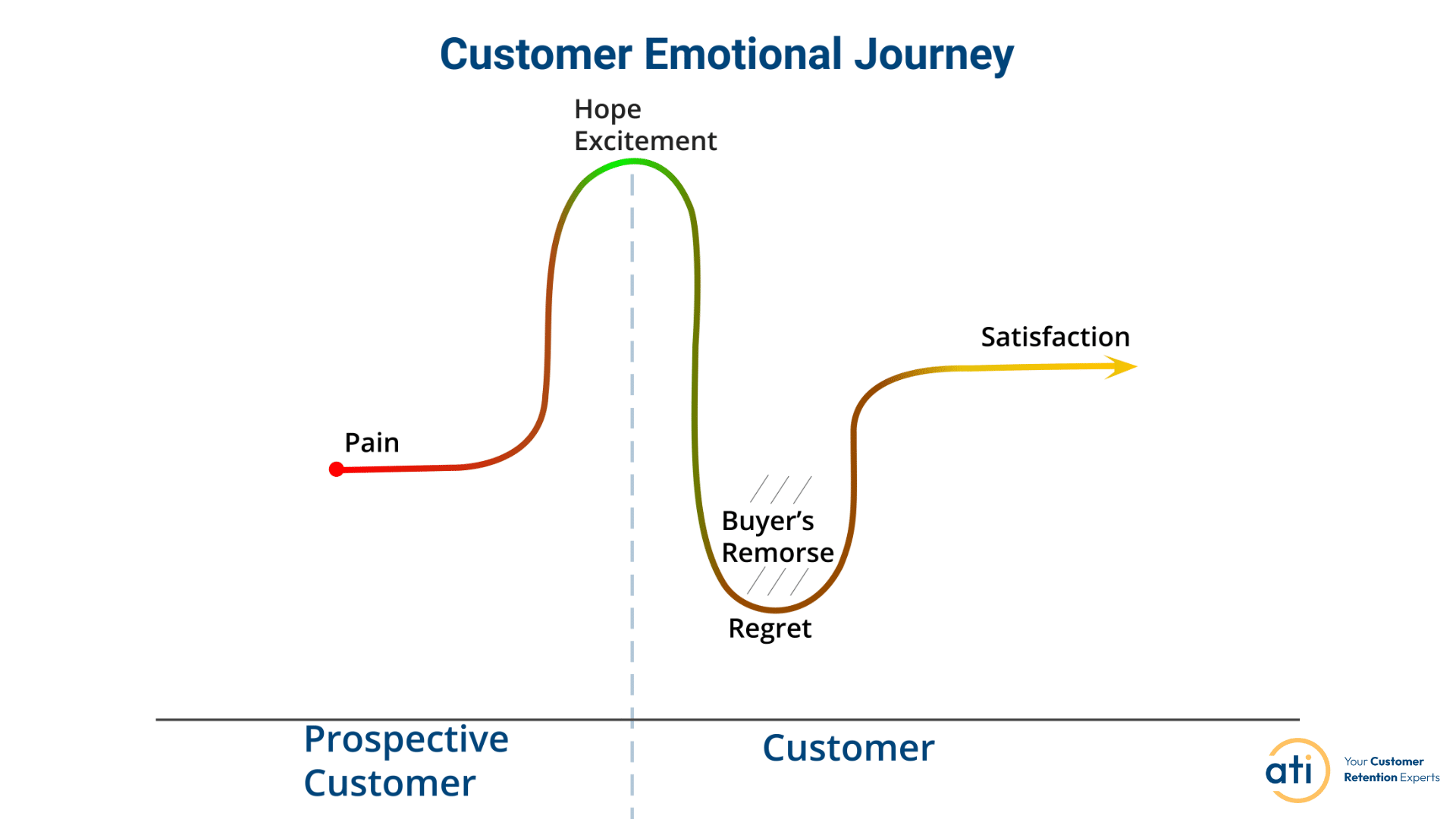

# 2. Early churn is caused by Buyer’s Remorse

Buyer’s Remorse is when customers quickly move from feeling hope or excitement about their purchase to regret.

We’ve all experienced Buyer’s Remorse. It feels awful. Look for places in your onboarding where Buyer’s Remorse can start to take hold. Then make changes to those spots. Keep improving your onboarding until you minimize Buyer’s Remorse. (Check out article #1 for more information.)

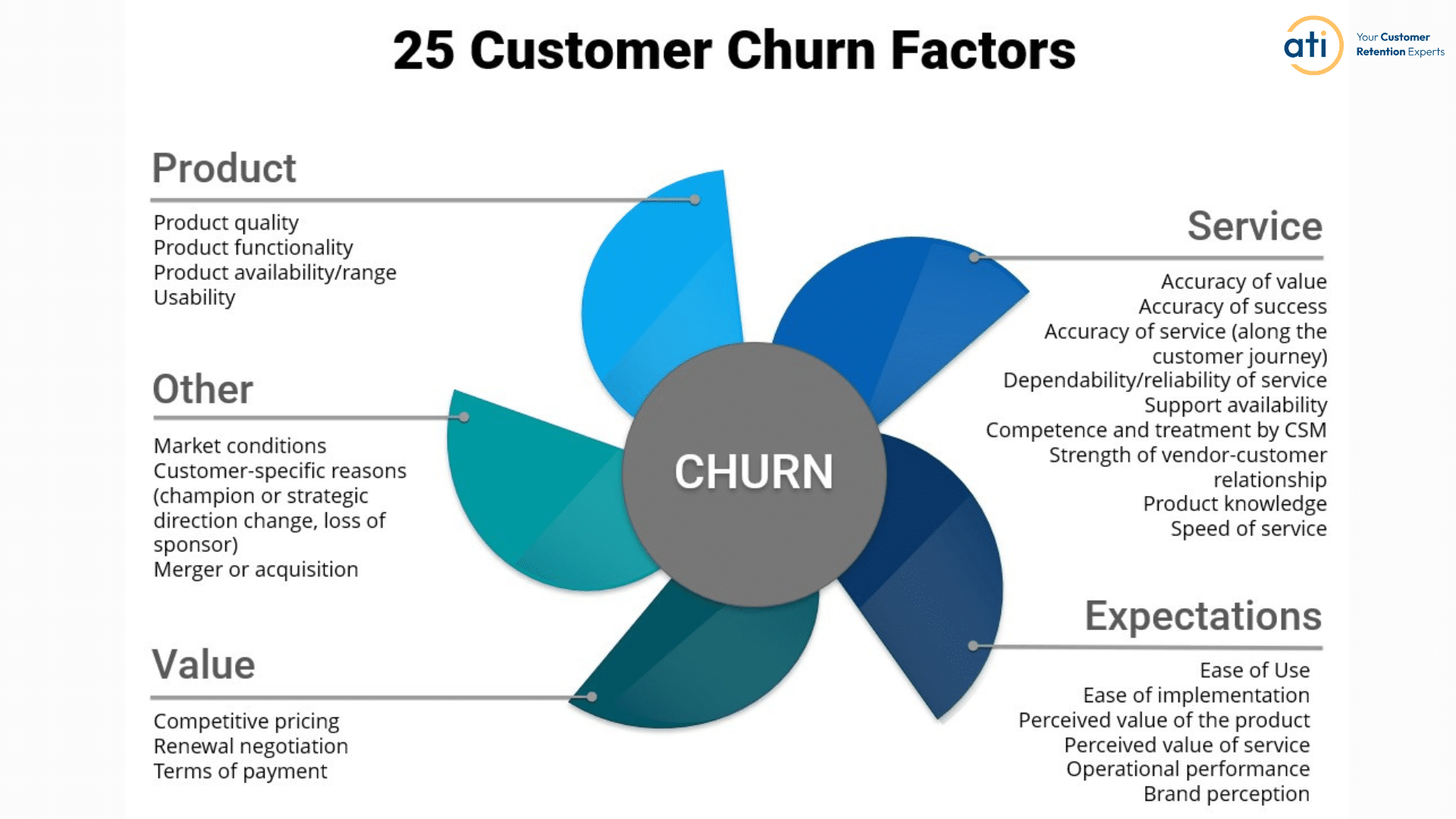

# 3. 25 churn factors

These 25 churn factors are what make improving retention a challenge. The good news is that the company has control over the majority of these factors. This means there’s a lot of opportunity to make things better. (Check out article #1 for more information.)

# 4. 3 tools to improve customer retention

In this series, we focused on customer insights.

#1. The ‘bits & pieces’ approach is where companies have some scattered customer retention activities but no cohesive strategy. The ‘bits & pieces’ approach is good for early startups. However, for growing companies, this approach loses leverage and momentum. And that means more time, money and resources are needed to move the retention needle.

#2. The right software, bought at the right time, can transform a company. And have a positive impact on the customers’ experience. It can help increase customer retention while also improving efficiencies and lowering costs.

One of the pitfalls with software is that companies expect the software to fix problematic processes. Once implemented, the software tends to amplify existing operational issues rather than solve them.

#3. Lastly, customer insights are any bit of customer information that gives you insights into the behaviors, thoughts, wants, needs and feelings of your customers. The greatest benefit of customer insights is that it’s a 360 degree view of what your customers are thinking, feeling, wanting and needing.

(Check out article #2 in this series for more information about the bits & pieces, software and customer insight tools.)

Using customer insights

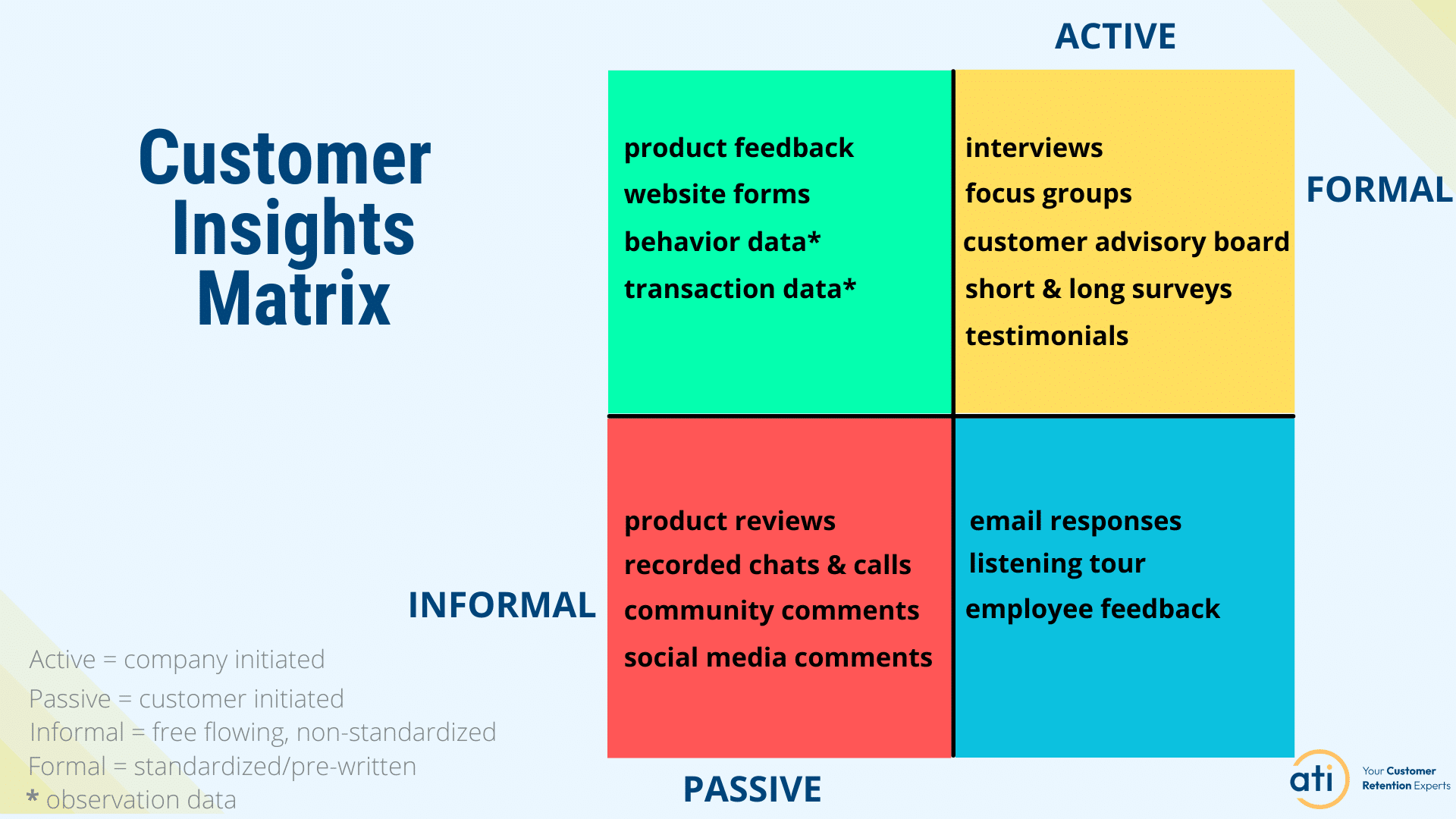

# 5. 4 ways to collect customer insights

Active insights are company initiated. The company sends out requests for feedback. Examples include surveys, focus groups and customer interviews.

Passive insights are customer initiated. The company doesn’t have any control over the type of insights they receive nor when these insights are generated. These include product reviews, product feature requests and support calls.

Informal customer insights are free-flowing and non-standardized. This means the customer has full autonomy to say or write what is on their mind like a social media comment.

Formal customer insights come from a standard format with pre-written questions or prompts that the company creates like interviews and surveys.

(Check out article #3 for more information.)

# 6. 3 customer retention strategy principles

1. When you’re first starting out, keep your strategy simple.

Because your customer retention strategy ties directly to revenues and profits, the last thing you want to happen is for those company priorities to be negatively affected by your new strategy. And that’s why you want to start with a simple strategy.

2. Your first strategy should start with one team.

Our client’s retention strategies always start with a specific post-sale team – Customer Success. Customer Success teams have a consistent and proactive relationship with the customer. They know which customers might be open to participating in customer insights activities – especially interviews.

3. The customer insights data collected through your retention strategy should be both continuously collected and collected for specific projects.

Most companies are great at having their surveys go out at regular intervals to get continuous customer insights. But they haven’t yet figured out that they can increase their customer retention by adding in project-specific customer insights.

Run a series of customer interviews before you implement a new project or process. The insights you collect will allow you to course correct before launching. Your customers will thank you for it!

(Check out article #3 for more information.)

Your customer retention strategy

# 7. Your strategy mix

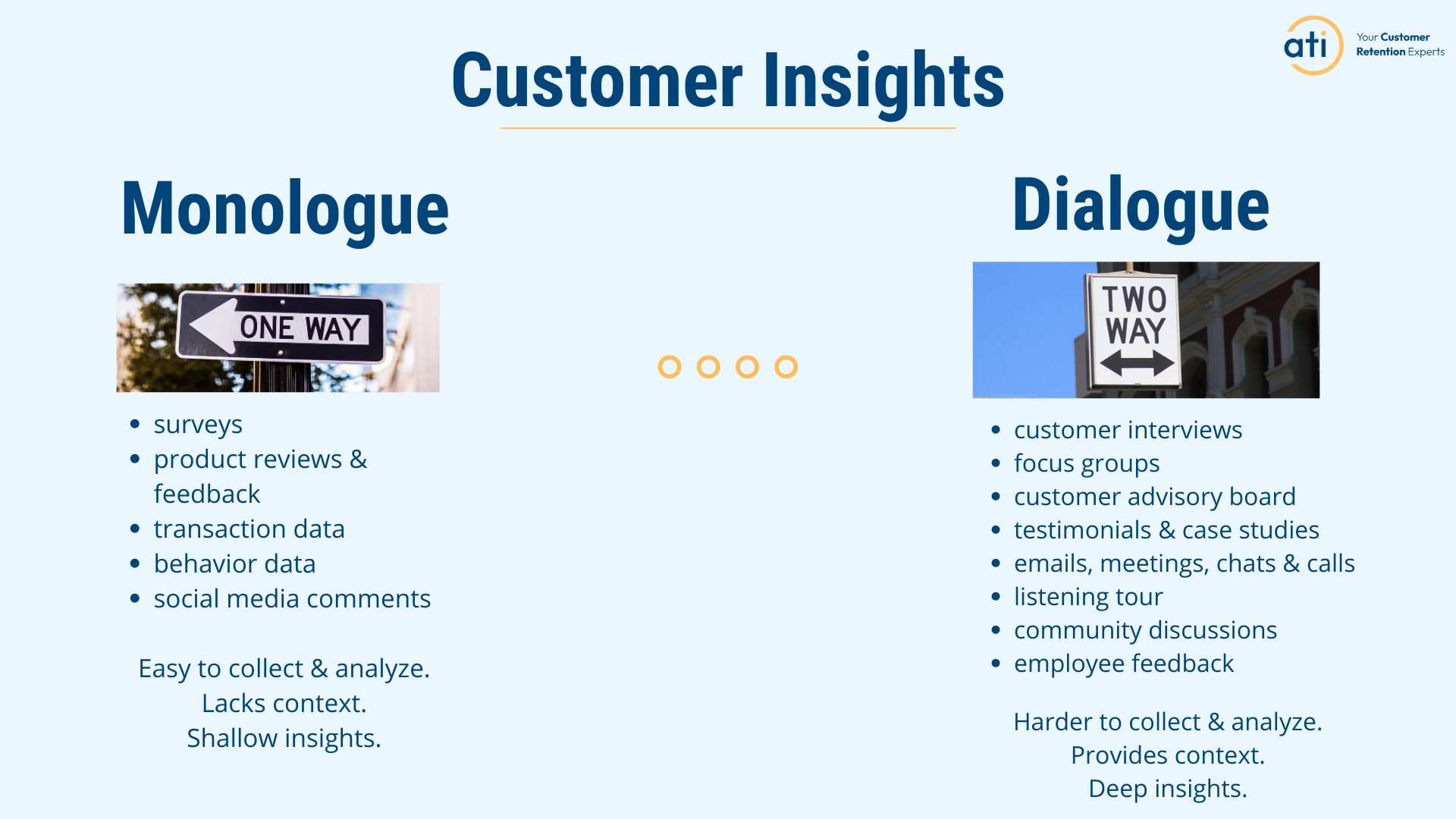

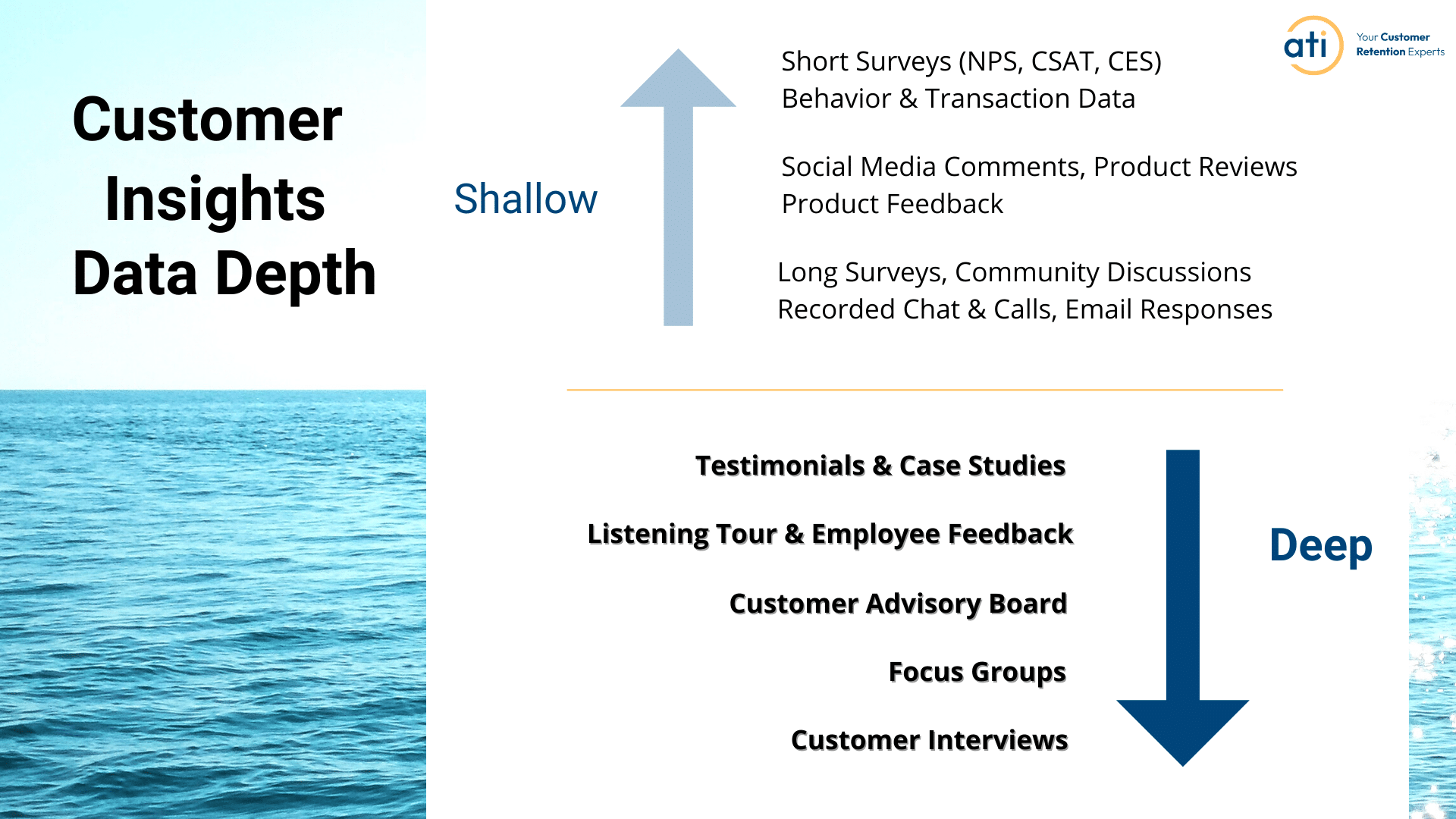

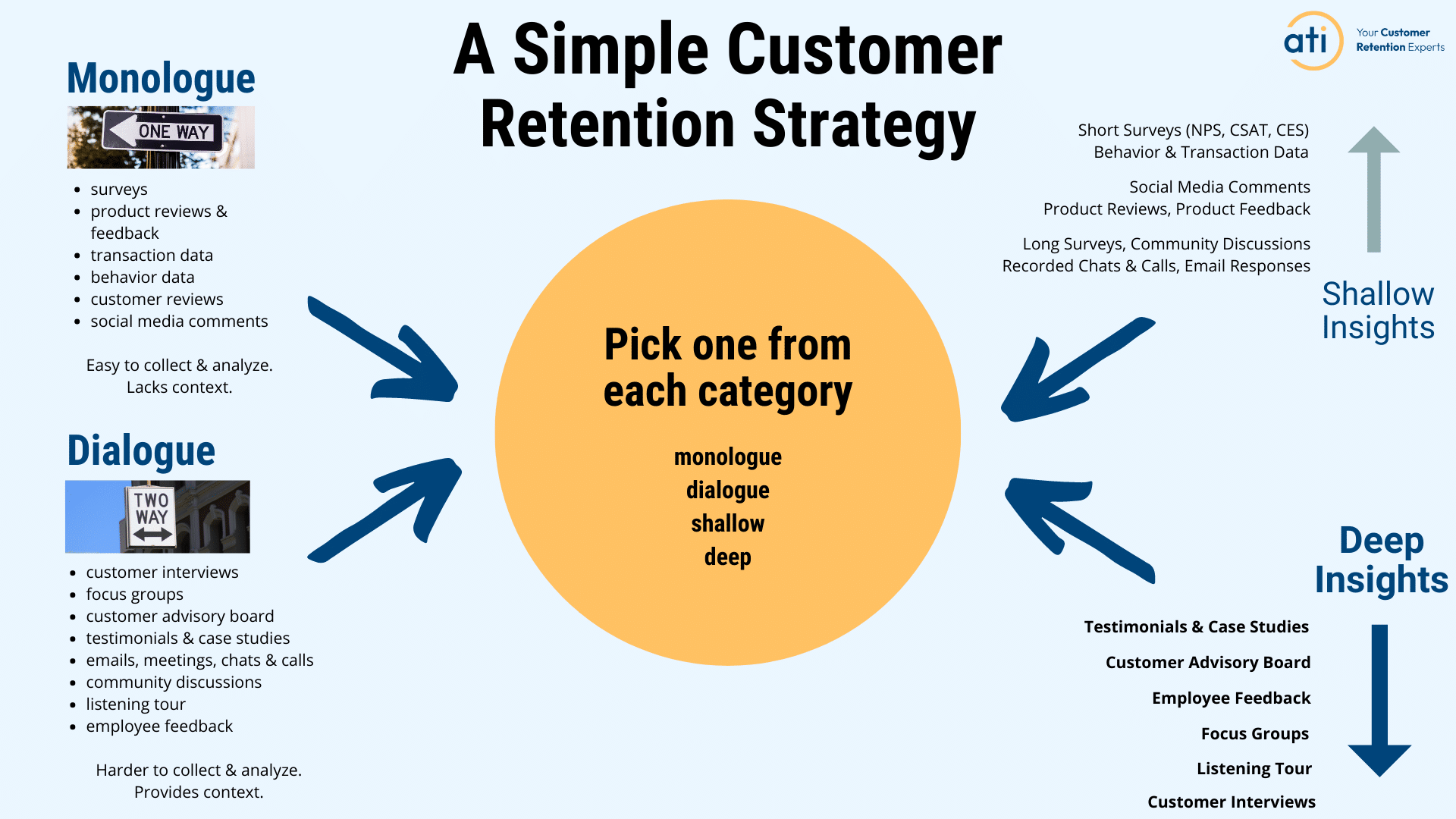

Your strategy needs a mix of monologue, dialogue, shallow and deep customer insights.

Monologue insights are very easy to collect and analyze. Monologue customer insight activities are often the first ones that companies implement.

The downside of customer insights gathered from monologue sources is that they lack context. Metrics or hard numbers don’t tell you anything about why the numbers are trending as they are.

Dialogue customer insights activities, on the other hand, are rich in context. There’s no need to guess or assume. You can simply ask your customer for more details.

The downside of dialogue sources of customer insights is that they are harder to analyze and collect. You can’t interview every one of your customers. And then try to analyze all that data. It’s time consuming and expensive.

Data depth refers to the richness of the customer insights you collect. Shallow data means the insights don’t tell you much. Deep data gives you a lot of insights which paints a bigger and more colorful picture.

Deep customer insights are from sustained communications, generally over a longer time. With more time and trust, customers feel they can open up and share information which is otherwise difficult to collect. It’s these difficult-to-access insights that are like striking gold.

(Check out article #4 for more information.)

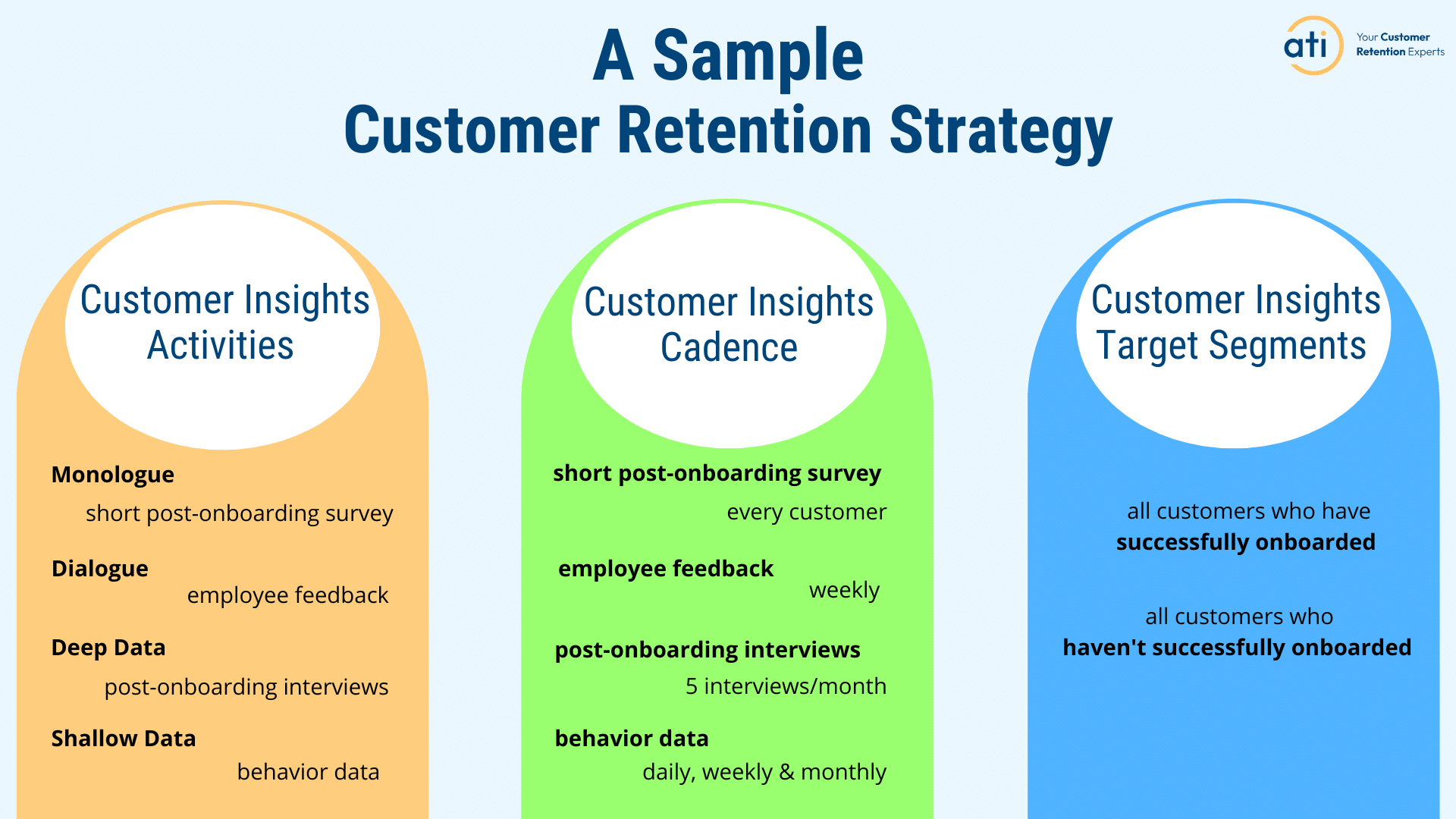

# 8. 4 customer insights activities

one monologue

one dialogue

one shallow

one deep

(Check out article #4 for more information.)

When you launch your strategy, you’ll need to also decide on the cadence of your customer insights activities as well as the customer segments you’ll target.

You’ll find your retention gold when you compare 2 customer segments by looking at their similarities and differences. Remember to keep the focus on the sentiment of these 2 groups – how are they similar and different.

(Check out article #6 for more information.)

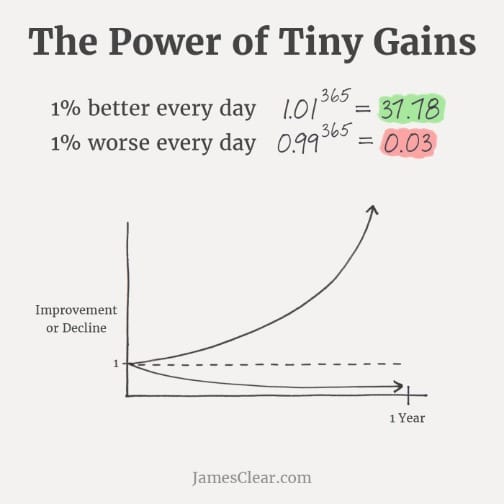

# 9. The power of 1%

When you first launch your strategy, you won’t notice much of a difference in retention. But over a short time, your small customer insight wins will add up to large impacts on your retention. This graph by James Clear, the author of Atomic Habits, shows you how powerful a daily 1% change adds up to a big difference over time.

Seek to get your small wins.

Improve by 1% each day.

See big retention gains over time.

(Check out article #5 for more information.)

Growing your strategy

# 10. Adding complexity and accuracy

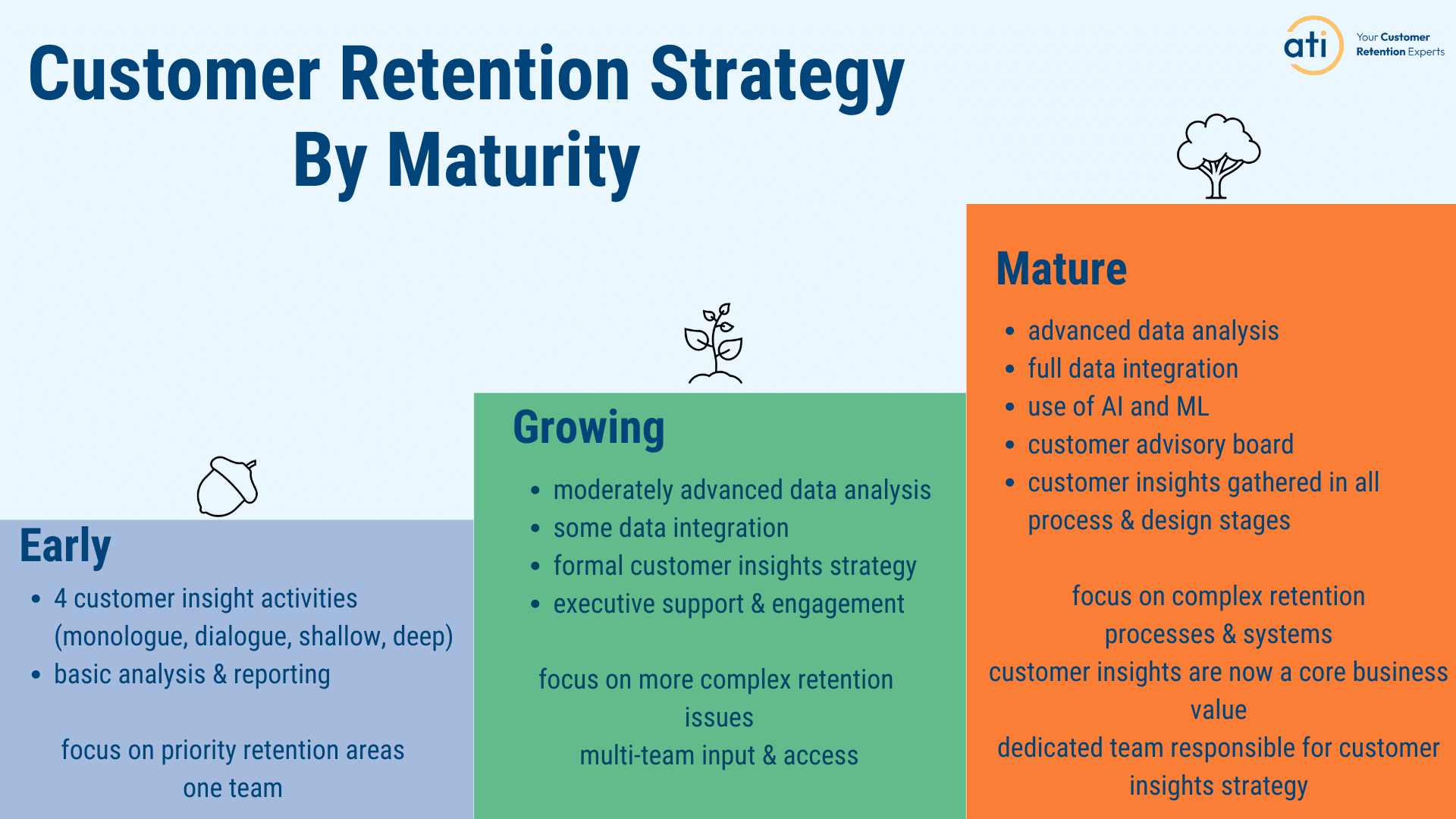

In the Early stage, focus on using the 4 customer insight activities you chose earlier (see #8 above). Your analysis and reporting at this stage will be basic. Choose to implement your strategy with priority retention areas like onboarding and pre-renewal.

(Check out article #5 for more information.)

# 11. Get the right data story for buy-in

Everyone loves a good story. Even data can tell a compelling story – if you follow the principles of good storytelling in your presentation to your executive team or board.

To tell a worthy data story, you’ll want to choose a focus, gather the right supporting metrics, use customer and company stories, address objections in your presentation, and anchor your budget ask by showing how your retention strategy is cheaper in the long run than staying with the status quo. (If you want step-by-step instructions to create a winning presentation, check out this guide.)

# 12. Run in-house or hire an expert 3rd party

Here are some things to consider:

- if your team has the skill set, competence, experience, resources and capacity to run the strategy

- whether you can overcome confirmation bias when collecting your customer insights and when analyzing, interpreting and reporting the results (check out article #8 for more information on how to avoid confirmation bias)

- if you want to add more complexity to your strategy

- if the number of customer insight activities grows beyond your team’s capacity to gather, analyze and interpret all your customer insights data

- if you want to fill any holes or inefficiencies that may be in your strategy

(Before deciding to hire an expert 3rd party or run your strategy in-house, you should ask yourself these 7 questions.)

Some more expert advice

Helping our clients and workshop participants launch their customer retention strategies, my team and I have learned a few things that I’d like to pass on to you to help you get the best start you can.

- Increasing retention is a lot like losing weight

Once you launch your strategy, you may not see your retention metrics move much (see #9 above). Then, you’ll hit a point where your customer insights activities will quickly and easily improve your retention rates. But after a while, it will become hard work again. And the big gains you saw earlier now become incremental changes that take more effort.

Just like losing weight – the start is slow. Then it suddenly becomes relatively quick and easy to shed the pounds. But then it becomes tough to get rid of that last bit of weight. That last bit of weight takes a lot of time and a lot more effort to lose.

Knowing that increasing customer retention is a lot like losing weight will help you when it becomes a bigger effort for a (seemingly) smaller reward.

- Find your allies

Eventually, your customer retention strategy will expand to include other teams and leaders in your company. Start building relationships with the leaders in finance, product, marketing and sales. The customer insights that you gain can benefit them. They can become early champions of a company-wide retention strategy. Consider building those relationships now while you build and launch your strategy.

- Build your support

At some point, you will encounter some bumps in your quest to increase your customer retention. Rather than trying to figure it out on your own, look for support from others. There are many customer success communities that you can join.

Our company has a community for our workshop participants to support them through their launch. Look for communities where you can ask questions and get answers that are both tactical and supportive.

We all know that happier customers stay longer.

They buy more.

And they’re more profitable.

When launching your customer retention strategy, I want you to remember this simple equation:

Happy Customers = Happy Business