This is Article #4 in the Customer Retention series.

This 9 part series teaches you how to build a predictable customer retention strategy. By the end of this series, you’ll be on your way to confidently increasing your customer retention.

- Why Customer Retention Is So Hard to Improve

- 3 Tools to Improve Customer Retention (only 1 is software!)

- The Best Customer Retention Strategy for Growing Companies

We’re at that point where you’re ready to build a predictable customer retention strategy. By the end of this article, you will have learned the key components that will create your strategy. I’ll give you the formula. You just need to find the right mix for you.

Are you ready?

The customer retention strategy mix

To build a strong, predictable customer retention strategy, you need to understand the key components that make up your strategy. Nearly all the companies my team and I work with have this mix wrong when they first come to work with us. They have too much of one type of customer insight activity and too little or none of another.

I don’t want that for you.

What I’m about to teach you here is the exact process we use with our clients to build them a customer retention strategy that predictably increases retention.

But first, you need to understand the components that you’ll use in your strategy. Every company will mix their formula a little differently. But the components remain the same. Once you learn these components, you can confidently tweak your mix to your ideal outcome.

Customer retention strategy component #1

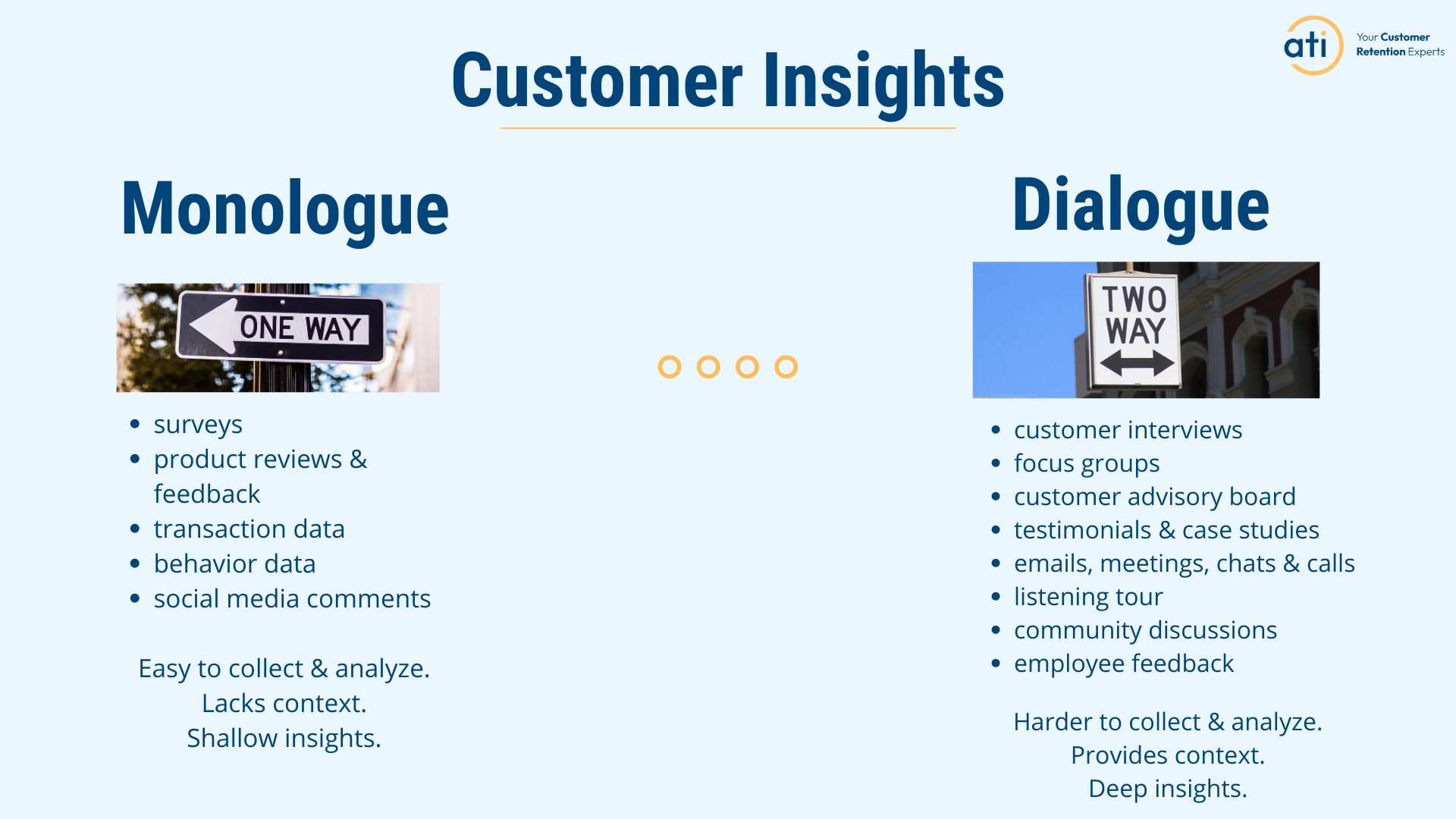

Monologue & Dialogue

If companies make one big mistake in their customer retention strategy, this is the place where they do it. They rely too heavily on customer insights gathered through monologue activities. And they often have too little or even no customer insights gathered from dialogue activities.

A predictable customer retention strategy requires a good mix of both. A good mix means the downfalls of one type of customer insight activity are compensated for by the other type.

Monologue insights are very easy to collect. They’re also very easy to analyze. It’s because they’re primarily metrics. Monologue customer insight activities are often the first ones that companies implement. Unlike dialogue customer insights, you collect data quickly with monologue activities.

The downside of customer insights gathered from monologue sources is that they lack context. Metrics or hard numbers don’t tell you anything about why the numbers are trending as they are. You have to guess or make assumptions. Sometimes you may be right. But you can also be quite wrong. And when you’re wrong, it can be devastating for you, your company, your employees, and your customers.

On the other hand, customer insights from dialogue origins are rich in context. There’s no need to guess or assume. You can simply ask your customer for more details. Gathering this context-rich data reduces the risk that you’re making an incorrect assumption. Incorrect assumptions lead to incorrect decisions. And incorrect decisions can be costly.

The downside of dialogue sources of customer insights is that they are harder to analyze and collect. You can’t interview every one of your customers. And then try to analyze all that data. It’s time consuming and expensive.

In article #3 of this series, I mentioned the biggest mistake I see companies making with surveys. This same mistake holds true with these larger customer insight categories – monologue & dialogue. Companies rely too heavily on the monologue category and have little to no customer insights gathered from the dialogue category.

A predictable customer retention strategy relies on a good mix of both. Collect context-rich customer insights through dialogue activities and then confirm if these insights are true across your larger customer base by using monologue methods.

For example, let’s say you interview 20 customers who just finished onboarding. You discover that 8 of them mention a specific issue that you haven’t heard about before. Because the sample size of 20 is so small, you’ll want to test and see if this insight holds true for all your customers who have just finished onboarding.

You can create a quick survey to see how many of your recently onboarded customers also experienced this issue. Then you can run a statistical analysis to see if the threshold of statistical significance was reached. If it is reached, then you can confidently make changes to correct the issue. If statistical significance wasn’t reached, you can either run a few more interviews to understand the issue more deeply or you can let it go and see what happens.

The point is it’s more powerful to use both monologue and dialogue customer insight methods to give you clarity and confidence that you’re on the right track with your decisions.

Customer retention strategy component #2

Data Depth

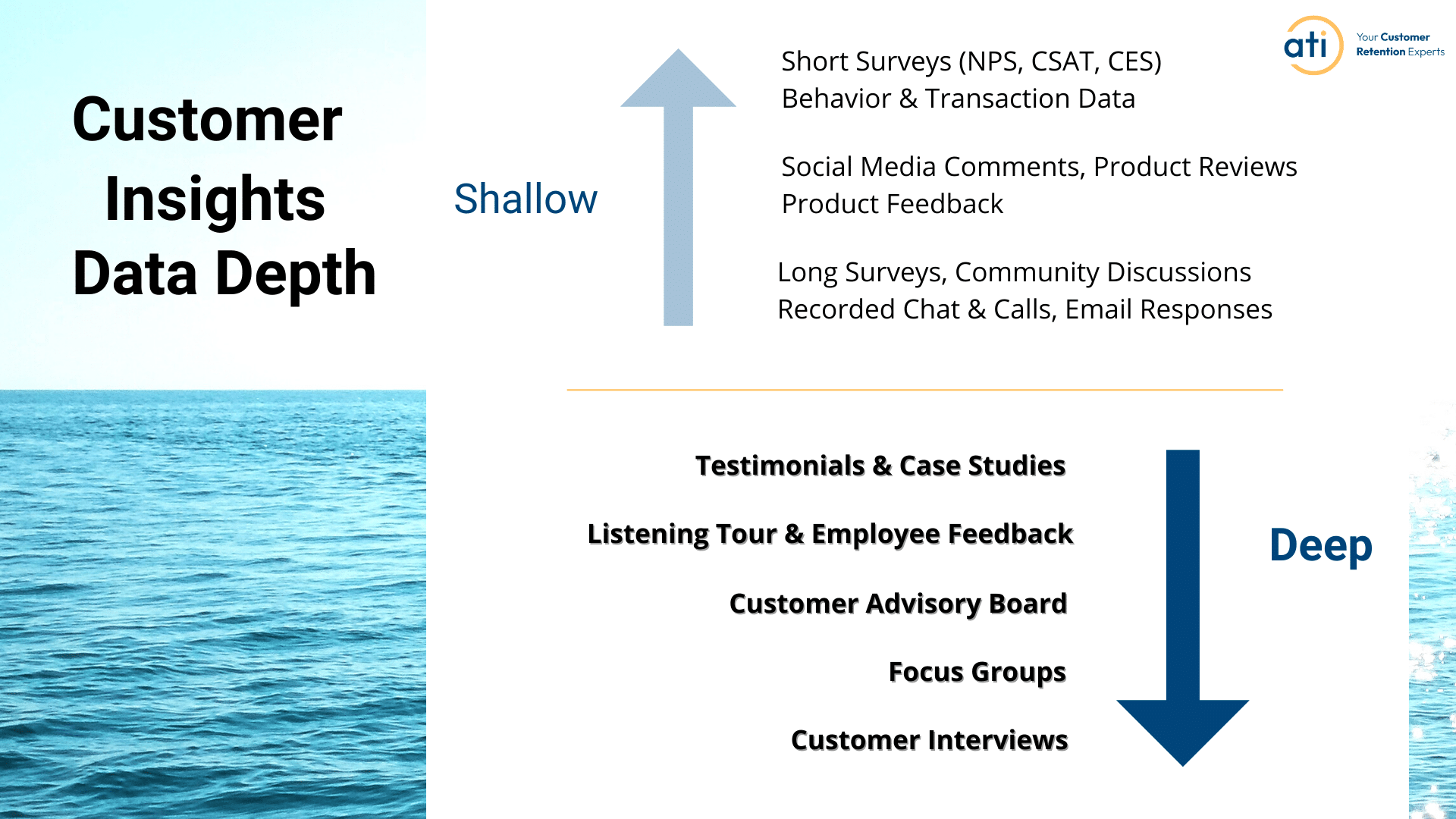

In addition to having the right mix of monologue and dialogue customer insights activities, you will also need to have the right data depth mix.

You’ve probably never heard of data depth. That’s ok. It’s a bit nerdy. But it’s an essential component of a predictable customer retention strategy. Data depth refers to the richness of the customer insights you collect. Shallow data means the insights don’t tell you much. Deep data gets you a lot of insights which paints a bigger and more colorful picture.

You’ll see from this diagram that all the monologue customer insights activities are shallow. This is because they lack context. But you’ll notice that some of the dialogue customer insight sources are also shallow. While they provide some context, it’s often very surface level and without much detail.

Deep customer insights are generated by an exclusive group of dialogue activities. These activities include sustained communications, generally over a longer time. With more time and trust, customers feel they can open up and share information which is otherwise difficult to collect. It’s these difficult to access insights that are like striking gold.

Here’s what I mean:

You want to understand why only 35% of customers are using a key feature they set up during onboarding. You know that customers who use this feature have more success than customers who don’t set it up. You’re also keenly aware that your more successful customers stay longer.

You send out a survey to your recently onboarded customers to understand why they don’t use this feature.

You get answers like “I didn’t use feature X because it was too hard to use.”

You ask some of those customers who responded to your survey if you can interview them. In the interview, you discover that the key feature in question isn’t being used because customers didn’t understand the documents outlining how to use the feature. Several customers mentioned they had struggled with understanding some of the words used in the documentation. They became confused. Rather than reaching out for help, they thought they could use the product just fine without that feature. They abandoned using the feature.

This example shows that there are 2 different interpretations of the situation. From the survey data, you understand that using that feature was hard. As a solution, you may choose to find a way to make the feature easier to use. From the interview data, you realize that the word definitions aren’t obvious for some customers. You revamp the support documents using words that are more in line with the words customers understand. Customer insights were collected using surveys and interviews. However, you see that the solution was vastly different because of the depth of the data you collected.

Both solutions will impact customers. Both solutions will impact retention. However, the solution that comes from the customer interview data will be more accurate. This means it’ll have a bigger and more positive impact on your retention than the solution derived from the survey data. Data depth matters!

Customer retention strategy component #3

Simplicity

At this point, you might be feeling a bit overwhelmed. So far, you’ve learned that a predictable customer retention strategy can be built from collecting customer insights. You’ve been introduced to both monologue and dialogue customer insight activities. You also see that different customer insight sources yield different depths of data – shallow or deep. In article #1, you were introduced to the customer’s emotional journey and the despair of Buyer’s Remorse.

We’re now going to cover the easiest component of your strategy – simplicity.

Simply put, your first customer retention strategy is going to be simple.

You’ll see what I mean in this next section.

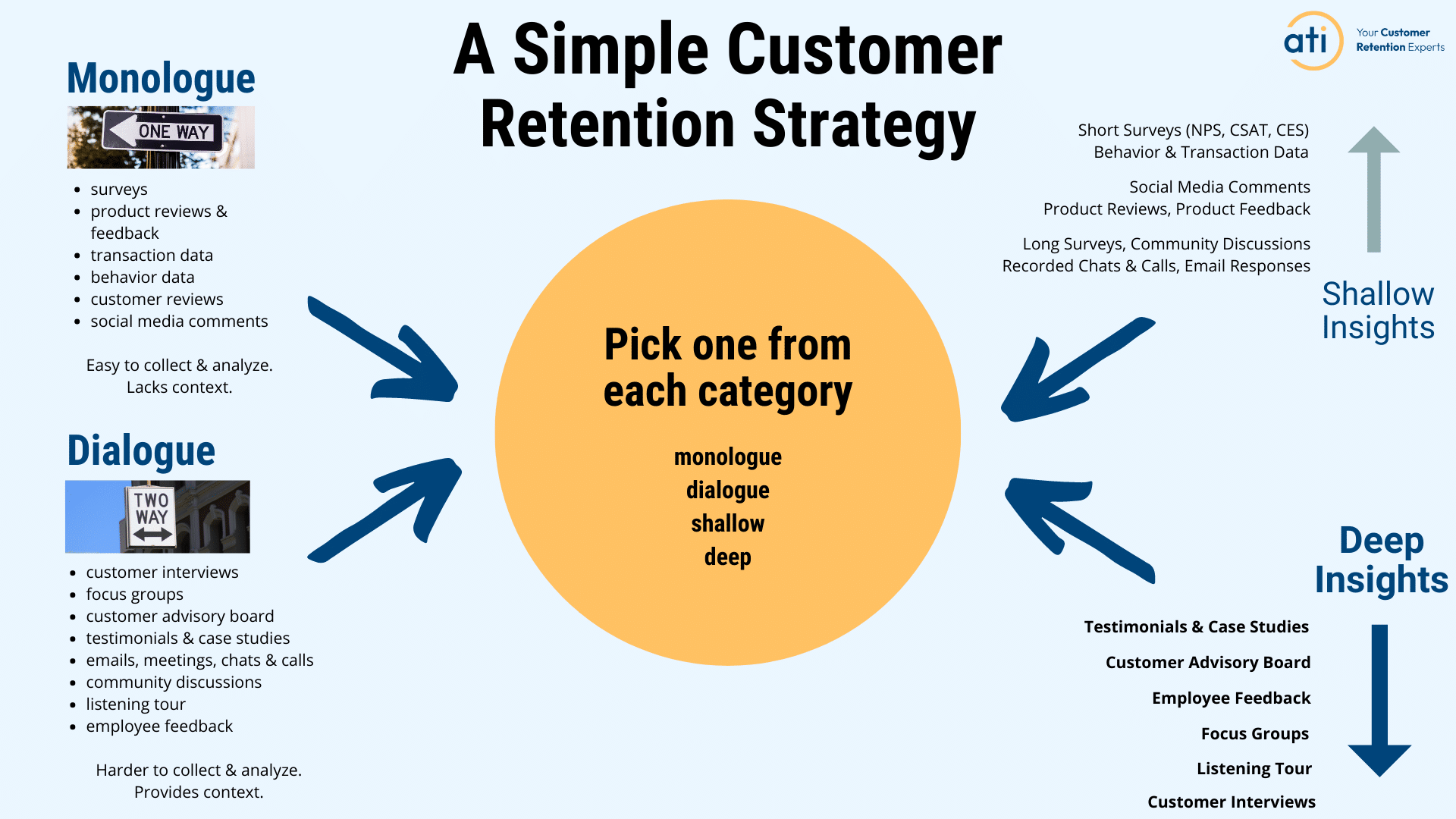

The customer retention strategy formula

We’re finally here. You’re going to create a simple, predictable customer retention strategy.

The formula is easy.

You’ll pick 4 customer insights activities:

one monologue

one dialogue

one shallow

one deep

Woohoo! You’ve created your predictable customer retention strategy! 🥳

Now you need to figure out the right mix of your components.

You’ll need to figure out:

- which activities you want to use the most

- how often you want to run those activities

- which customer segments you’ll use these activities with

In a later article (article #6), you’ll see a sample retention strategy example that answers these 3 questions. By that point, you’ll have a very clear idea of how to mix your own customer retention formula to get a strategy that gives you predictable results.

In the next article, I’m going to show you how to use the small wins from your new customer retention strategy to get big retention gains. Don’t be fooled by the simplicity of this method. As you’ll shortly see, starting with small wins is literally a game-changing winning strategy.

Next article: How to Use Small Customer Insights to Get Large Customer Retention Wins

Churn No More: A Tactical Workshop for Customer Retention

A game-changing workshop designed to help you identify your next high-value retention win and earn a seat at the executive table. Consider it your FastPass to big retention wins.