This is Article #6 in the Customer Retention series.

This 9 part series teaches you how to build a predictable customer retention strategy. By the end of this series, you’ll be on your way to confidently increasing your customer retention.

- Why Customer Retention Is So Hard to Improve

- 3 Tools to Improve Customer Retention (only 1 is software!)

- The Best Customer Retention Strategy for Growing Companies

- How to Build a Predictable Customer Retention Strategy

- How to Use Small Customer Insights to Get Large Customer Retention Wins

This is it! We’ve covered some serious ground. By now, you’ve picked the 4 customer insights activities (1 monologue, 1 dialogue, 1 shallow & 1 deep –from article #4) that will be the foundation of your customer retention strategy.

You also know the priority area in which you’ll launch your strategy. (I highly recommend you choose onboarding.)

You now understand that to get large retention gains you have to start with small customer insight wins. You also know to keep everything simple for now.

In this article, you’re going to see what a sample customer retention strategy looks like. And what a strategy launch looks like. We’ll also cover how to identify those golden customer insights that can lead to immediate retention wins.

An example of a customer retention strategy

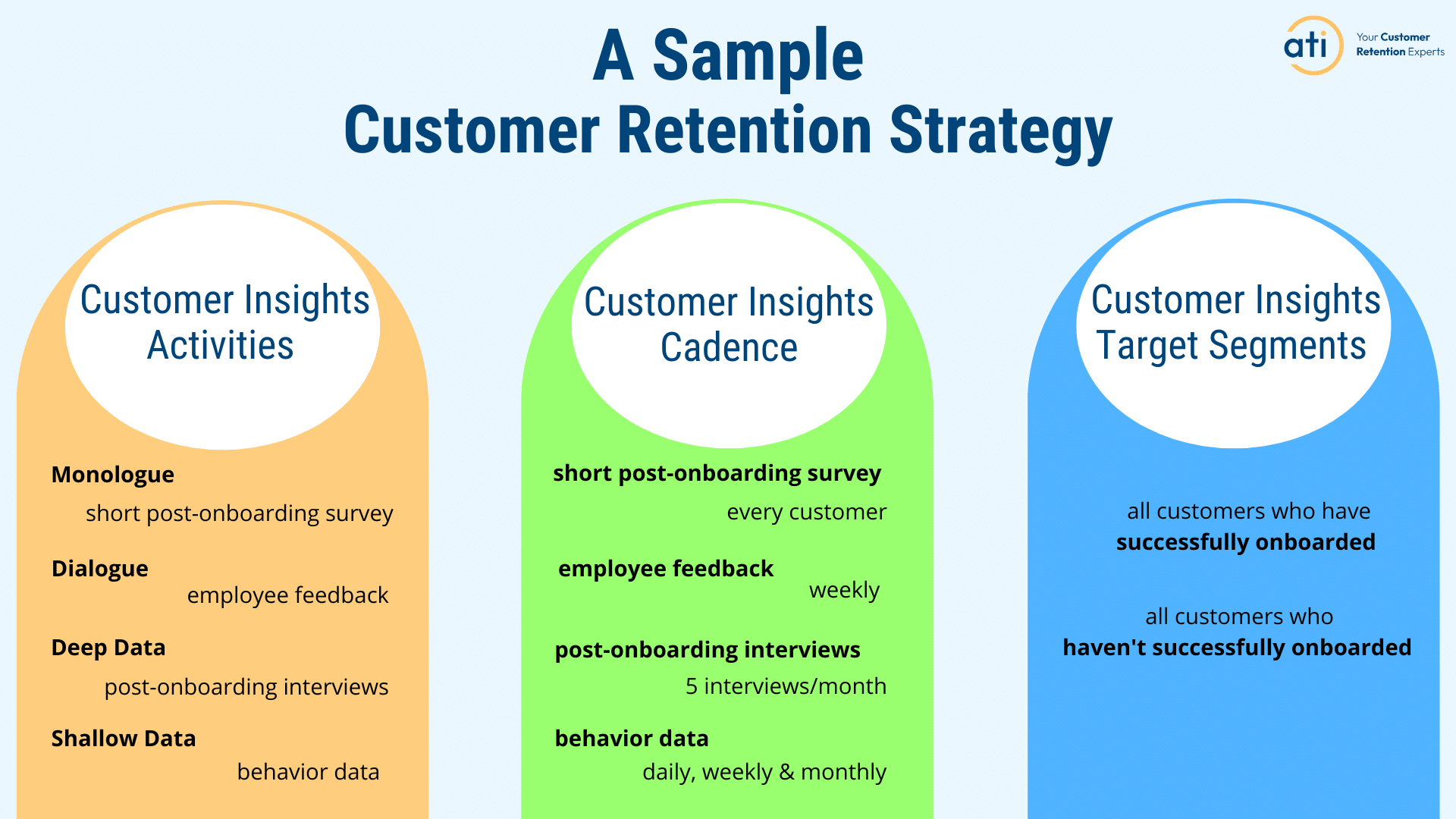

Like I mentioned earlier, keeping it simple is the key to creating predictable customer retention wins at this early stage. Here’s an example of a simple customer retention strategy.

On the far left, you see the customer insights activities I picked from each of the 4 customer insights categories (monologue, dialogue, shallow and deep). In the middle, you can see the cadence for each of these activities. On the right side, you’ll see which customer segments I’ve chosen to target.

I’ve always found it helpful when an expert walks me through the choices they’ve made whenever I’m learning new material. It helps me see that their choices weren’t just random – they chose these specific items for a reason. I’m going to do the same for you now and walk you through my thought process when I created this sample customer retention strategy.

Customer insights activities

I chose a short post-onboarding survey for the monologue customer insights activity. This would be a 3 or 4 question survey to understand what the customer thought of the onboarding experience. At the bottom of that survey, I would ask if the customer would like to participate in a short interview. Given they just filled out the survey, they are more likely to agree to participate in an interview (deep data).

The dialogue customer insights activity I chose is employee feedback. Customer Success Managers interact all the time with customers. They can tell you what their book of customers is saying about the onboarding experience. CSMs can also keep track of new or different things they’re hearing over time.

The last activity is behavior data (shallow data). Observing behavior data means looking at your metrics to see if the data you gather from the surveys, employee feedback and interviews follows the same patterns as your metrics.

If the survey, employee feedback and interview data are at odds with your hard data, that’s not a bad thing at all. It means there’s likely the potential for a big retention opportunity. (And if your metrics and survey, employee feedback and interview data support each other, you’re on the right track!)

Customer insights cadence

In the 4th article of this series (How to Build a Predictable Customer Retention Strategy), we talked about having the right mix of customer insights components to create a predictable customer retention strategy. Customer insights cadence is where you will have to decide which is the right pace for you.

For the sample customer retention strategy, I chose to have a short post-onboarding survey sent to every customer. Typically, surveys have a low response rate. It’s not uncommon to have 5-20% of your customers fill them out. The goal is to get at least 15% of your target customers to respond when you first launch your strategy.

Over time, you want to work to increase that number to over 30%. Thirty percent is a reasonable response rate for surveys. The higher you can get your response rate, the more you can be confident that your data is accurate.

(Note: If you have a high volume customer base, you can choose to send out fewer surveys – maybe every 5th, 25th or 100th customer. Pick a number and test it out. Adjust how many surveys you send out to hit that minimum 15% response rate.)

I chose to have employee feedback insight data collected on a weekly basis. You can easily add a few minutes to your weekly meetings to specifically focus on new insights your team is hearing from your customers. Some weeks, you may not hear much. But if there’s turbulence in the economy, you’ll be hearing and gathering a lot of new insights.

Post-onboarding interviews can be collected weekly, monthly or quarterly. With our clients, we use a quarterly approach. This means we’ll run a larger number of interviews all at once, typically in a 2 week sprint. The benefit of doing this is that we can analyze a larger amount of data which allows us to better confirm the accuracy of the data we’ve collected.

You might not have the luxury of setting aside 2 weeks just to conduct customer interviews. That’s ok. Choose a monthly or weekly target number that you can reasonably handle. Interviews are time intensive, both in terms of running the interview and in analyzing the data. I’d rather see you undertake 1 customer interview every week than set a monthly target that you never hit.

Remember!

Customer interviews are the most powerful customer insight activity you can use that has a direct impact on your customer retention. Interviews are your retention goldmine.

Behavior data is simply the usage and other customer data you collect. You’ll likely already have daily, weekly and monthly metrics you track. Choose whichever cadence works best for you.

Customer insights target segments

In the previous article (How to Use Small Customer Insights to Get Large Customer Retention Wins), I mentioned that onboarding was the best place to launch your new strategy. You may have noticed that the diagram includes both customers who successfully onboarded and those who didn’t.

It’s a little known expert secret that the easiest way to spot retention opportunities is by collecting insights from both groups. By comparing the similarities between the groups and by looking for the differences, you’ll start to see opportunities for change.

This is your retention gold!

Your successfully onboarded customers will think, feel and behave differently than your customers who didn’t complete onboarding.

Pay attention to those differences!

Those differences hold your small retention wins!

How to find retention opportunities from your data

You just learned a pro tip that we use with our clients to find low-hanging retention opportunities – compare 2 groups of your customers. Look for what’s similar in both groups and look for the differences. It won’t take you long to start seeing all sorts of retention opportunities when you first launch your customer retention strategy.

The second key thing to pay attention to is sentiment. Remember way back in the first article (Why Customer Retention Is So Hard to Improve), you learned about Buyer’s Remorse. It’s when customers quickly move from being excited and hopeful about your product solves their problem, to regretting their decision to buy.

When you’re analyzing your customer insights data from your surveys, interviews and employee feedback, look for words that indicate both a positive and negative sentiment. Dive deep to see which segment of your customers (successfully onboarded or unsuccessfully onboarded) displays which type of sentiment most often.

Another Pro Tip!

Ask sentiment questions during your customer interviews. Find out how customers felt when they purchased and what they were hoping to achieve. Ask questions to see if that sentiment changed. If it did, when did it happen? And what happened to cause them to change from feeling positive to now having a negative feeling.

Like I said earlier, these differences are where you’ll find your retention gold!

Making changes to improve your customer retention

Within the first 8 weeks of launching your retention strategy, you will start seeing all sorts of retention opportunities. Throughout this series, you’ve heard over and over again to keep it simple and start small.

You’ll likely want to start making changes throughout your onboarding to start increasing your retention rates. We coach our clients on why this isn’t a good approach.

I worked in a university research institute for over 20 years. We used the scientific method. Part of that method is to make one change at a time and then track the impact of that change.

Then you make another change.

And you track that change . . . and so on.

The brilliance of the scientific method is that you know precisely whether your change had an impact. You’ll also see whether that impact is positive or negative.

Pick one change you want to make to increase your retention. Track that change through your metrics and in the responses from your surveys, customer interviews and employee feedback. Within a relatively short time, you’ll know the impact of that change.

Now that you’ve launched your customer retention strategy, you’ll want to share your wins with your executive team or board. You’ll also likely want to ask for a bigger budget to take your early wins and expand them to have an even greater positive impact on customer retention.

In the next article, you’ll learn the 5 proven steps to get the budget to expand your customer retention project. You’ll discover the exact steps you can take to show how your small customer insight wins can add up to huge retention gains.

Next article: 5 Proven Steps to Get The Budget for Your Customer Retention Project

Churn No More: A Tactical Workshop for Customer Retention

A game-changing workshop designed to help you identify your next high-value retention win and earn a seat at the executive table. Consider it your FastPass to big retention wins.